CPTPP partner: Mexico

CPTPP partner: Mexico

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) is a trading block that represents 495 million people with a combined gross domestic product of CAD $13.5 trillion – a full 13.5% of global GDP. Through the CPTPP, Canada now has preferential access to some of the world’s most dynamic and fast-growing markets, which will strengthen Canadian businesses, grow the economy, and create more well-paying jobs for middle class Canadians.

The CPTPP entered into force for the first six countries to ratify the Agreement – Australia, Canada, Japan, Mexico, New Zealand, and Singapore – on December 30, 2018, for Vietnam on January 14, 2019, and for Peru on September 19, 2021. For the remaining signatories (Brunei, Chile, and Malaysia), the CPTPP will enter into force 60 days after that country ratifies the Agreement.

Why Mexico matters

- Mexico is Canada’s third-largest trading partner.

- In 2016, Mexico was Canada’s fifth-largest export market and our third-largest source of imports.

- Approximately 2,000 Canadian enterprises exported to Mexico in 2016.

- Mexico’s foreign direct investment stock in Canada was valued at $1.7 billion in 2016; Canadian foreign direct investment stock in Mexico was valued at $16.8 billion in 2016.

- Mexico was Canada’s 12th-largest source country for international students in 2017 (6,920 long-term students).

Canada-Mexico trade snapshot

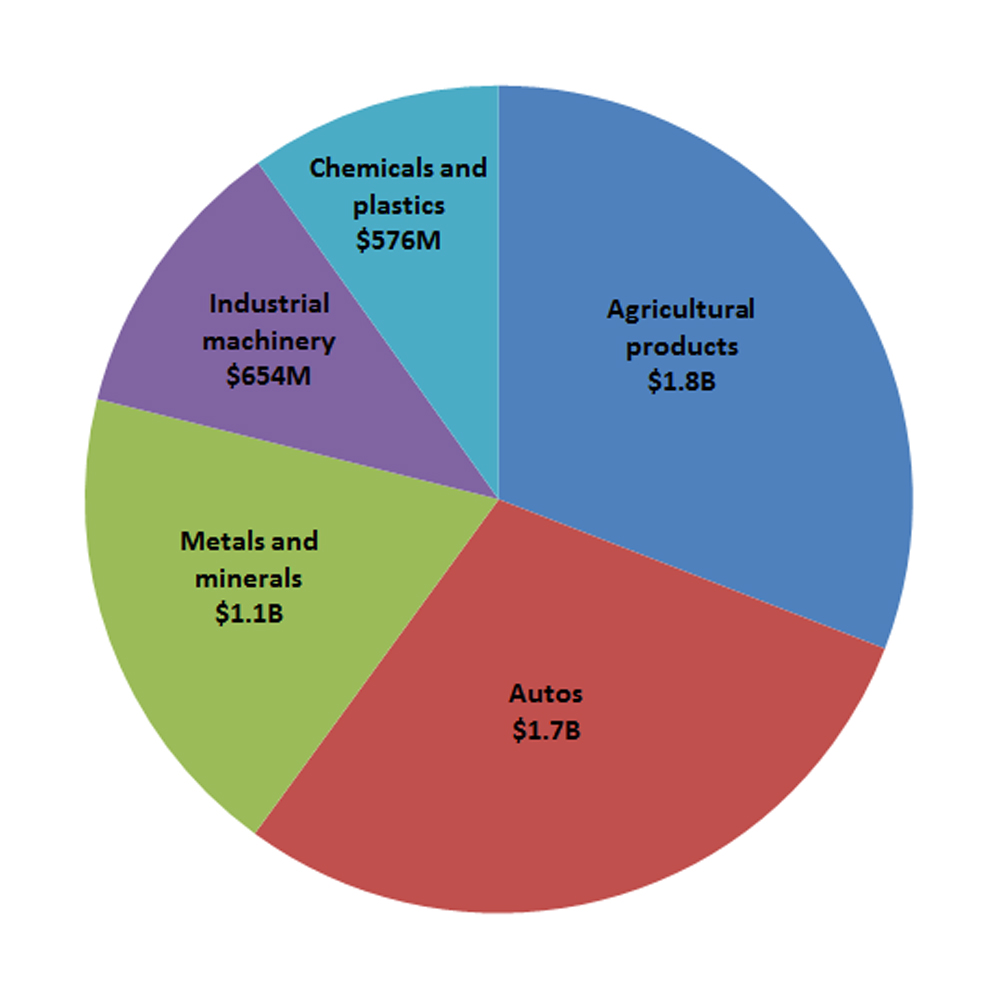

Top Canadian Exports to Mexico (2015-2017 average, $CAD)

Text version

Key facts and figures

Canada-Mexico trade

- Canadian merchandise exports: $7.3 billion (2015-2017 average)

- Canadian merchandise imports: $32.3 billion (2015-2017 average)

- Canadian service exports (2016): $1.1 billion

- Canadian service imports (2016): $3.2 billion

Canada-Mexico tourism

- In 2016, Canada welcomed approximately 250,000 visitors from Mexico.

- Mexico was the second largest tourism destination for Canada in 2016, with 2.1 million Canadians visiting Mexico.

Canada’s top merchandise imports from Mexico (2015-2017 average)

- Autos: $13.7 billion

- Electronic and electrical machinery and equipment: $7.1 billion

- Miscellaneous industrial products: $3.2 billion

- Agricultural products (vegetables, fruits): $2.4 billion

- Industrial machinery: $1.9 billion

Canada’s imports of services from Mexico (2016)

- Travel: $2.5 billion

- Commercial: $425 million

- Transportation and government: $263 million

Canada’s top merchandise exports to Mexico (2015-2017 average)

- Agricultural products (canola, wheat): $1.8 billion

- Autos: $1.7 billion

- Metals and minerals: $1.1 billion

- Industrial machinery: $654 million

- Chemicals and plastics: $576 million

Canada’s exports of services to Mexico (2016)

- Commercial: $664 million

- Travel: $357 million

- Transportation and government: $139 million

How the CPTPP helps Canada-Mexico trade and investment

- Thanks to the North American Free Trade Agreement, Canada already enjoys preferential market access and clear trading rules with Mexico. The CPTPP provides modernized trade rules and gives exporters greater flexibility to use inputs from CPTPP members. Canadian exporters are able to choose between the trade agreements and claim preferences under the agreement that best fits their needs.

- On investment, the CPTPP will allow Canadian companies to invest with greater confidence in Mexico, offering them protections from unfair and discriminatory treatment, as well as greater predictability and transparency.

- Through the CPTPP, the service industry also benefits from more predictable access and greater transparency in Mexico, including in key sectors such as:

- professional services (e.g. legal services, architectural and engineering services)

- computer and related services and

- environmental services.

- New commitments on temporary entry of business people make it easier for certain categories of Canadian business people to temporarily work in Mexico, including high-skilled Canadian professionals and technicians as well as spouses.

- The CPTPP also provides robust and enforceable provisions on labour and environment.

Sectoral opportunities in Mexico

- Canada’s priority sectors in Mexico are aerospace, agriculture, creative industries, education, information and communications technologies, infrastructure, life sciences, mining, oil and gas, and sustainable technologies.

- Mexico’s abundance of natural resources, particularly in the mining sector, has generated interest from Canadian companies for many years.

- Agri-food makes up 24% of Canada’s exports to Mexico.

- Canada’s experience in infrastructure and public-private partnership projects is key in generating business opportunities in transport, electricity, water and hydrocarbons.

- The lifting of the visa requirement for Mexican travellers creates considerable opportunities for Canada’s education sector.