CPTPP partner: Japan – Canada

CPTPP partner: Japan

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) is a trading block that represents 495 million people with a combined gross domestic product of CAD $13.5 trillion – a full 13.5% of global GDP. Through the CPTPP, Canada now has preferential access to some of the world’s most dynamic and fast-growing markets, which will strengthen Canadian businesses, grow the economy, and create more well-paying jobs for middle class Canadians.

The CPTPP entered into force for the first six countries to ratify the Agreement – Australia, Canada, Japan, Mexico, New Zealand, and Singapore – on December 30, 2018, for Vietnam on January 14, 2019, and for Peru on September 19th, 2021. For the remaining signatories (Brunei, Chile, and Malaysia), the CPTPP will enter into force 60 days after that country ratifies the Agreement.

Why Japan matters

- Japan is the world’s third largest economy, with a significant consumer market and is a key participant in global value chains.

- Canada and Japan share common science, technology and innovation objectives. These include facilitating commercialization of new technologies, fostering public‑private‑academic collaboration, and supporting small- and medium-sized enterprises.

- Japan is Canada’s fourth largest trading partner with $29.3 billion in bilateral merchandise trade (in 2017).

- Japan is also Canada’s largest source of foreign direct investment ($29.1 billion, 2016) from Asia and sixth largest globally.

- Japan is Canada’s second largest global market for wheat ($598.6 million) and second largest market for canola seeds and pork (2016).

Canada-Japan trade snapshot

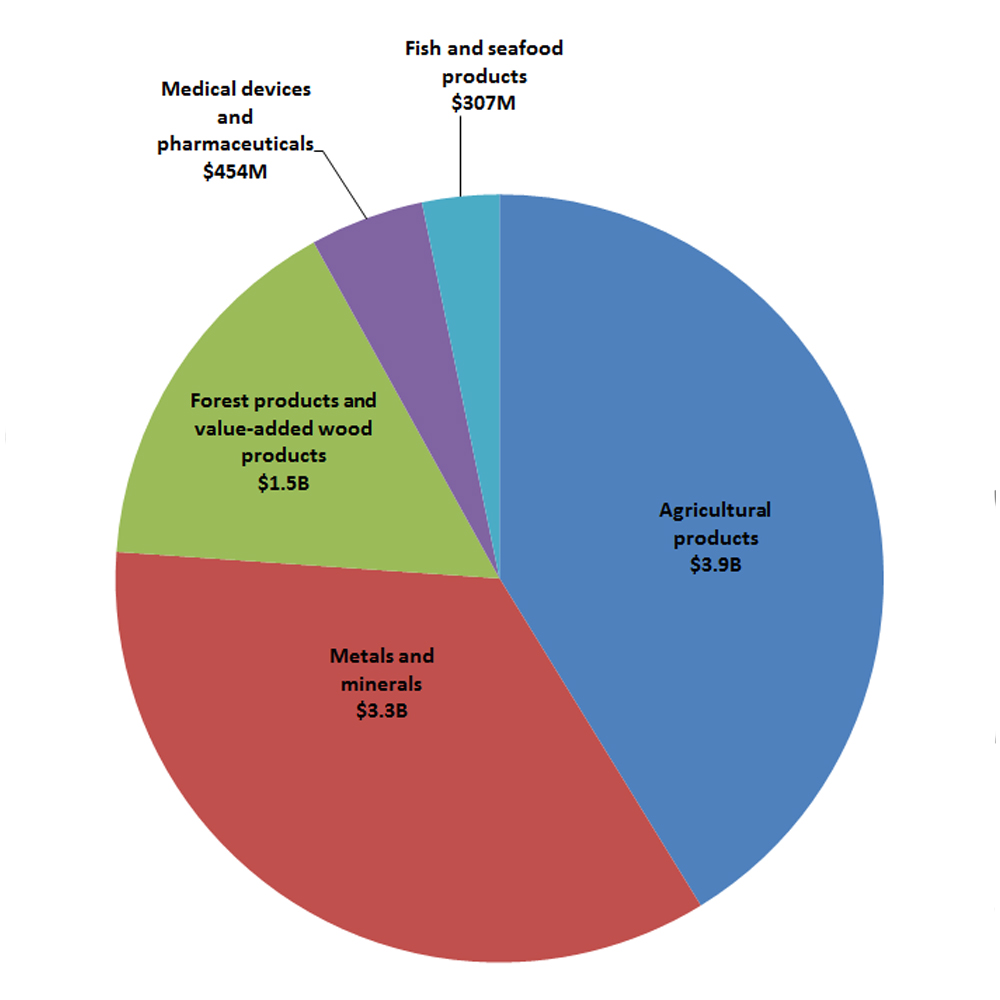

Top Canadian Exports to Japan (2015-2017 average, $CAD)

Text version:

Key facts and figures

Canada-Japan trade

- Canadian merchandise exports: $10.6 billion (2015-2017 average)

- Canadian merchandise imports: $16.0 billion (2015-2017 average)

- Canadian service exports (2016): $1.9 billion

- Canadian service imports (2016): $2.3 billion

Canada-Japan tourism

- In 2016, Canada welcomed more than 322,000 visitors from Japan, who spent $581 million.

- Through the International Experience Canada program, 6,000 Japanese youth visit Canada annually.

Canada’s top merchandise imports from Japan (2015-2017 average)

- Autos: $6.1 billion

- Industrial machinery: $3.7 billion

- Electronic and electrical machinery and equipment: $2.0 billion

- Metals and minerals: $1.3 billion

- Miscellaneous industrial products: $1.1 billion

Canada’s top service imports from Japan (2016)

- Commercial: $1.3 billion

- Transportation: $765 million

- Travel: $180 million

Canada’s top merchandise exports to Japan (2015-2017 average)

- Agricultural products (including canola seed, pork cuts and wheat): $3.9 billion

- Metals and minerals: $3.3 billion

- Forest products and value-added wood products: $1.5 billion

- Medical devices and pharmaceuticals: $454 million

- Fish and seafood products: $307 million

Canada’s top service exports to Japan (2016)

- Commercial: $784 million

- Transportation: $573 million

- Travel: $547 million

How the CPTPP helps Canada-Japan trade and investment

- The CPTPP strengthens the rules-based trading environment and provides enhanced market access for exporters and investors in Japan.

- The CPTPP agreement on autos between Canada and Japan addresses a number of non-tariff barriers in the auto sector, and is legally binding and fully enforceable under international law. Its key features include:

- commitments on automotive standards and regulations

- a specialised and accelerated dispute settlement mechanism

- a special transitional safeguard that can be applied to protect Canadian vehicle manufacturers if there is a surge of imports from Japan

- the establishment of a bilateral committee to discuss issues affecting motor vehicle trade and investment.

- The CPTPP establishes duty-free access for trade in goods between Canada and Japan, eliminating tariffs for key Canadian exports including:

- agricultural goods, such as:

- canola oil (tariffs of up to 13.20 yen/kilogram will be eliminated within five years) and

- frozen blueberries (tariffs of up to 9.6% were eliminated upon entry into force)

- fish and seafood products:

- snow crab (tariff of 4% were eliminated upon entry into force)

- lobster (tariff of 5% were eliminated upon entry into force) and

- salmon (tariffs of up to 3.5% will be eliminated within 10 years)

- forest products and value-added wood products, such as:

- lumber (tariffs of 6% will be eliminated within 15 years)

- plywood and veneer panels (tariffs of up to 10% will be eliminated within 15 years) and

- worked coniferous and non-coniferous wood (tariffs of up to 7.5% were eliminated upon entry into force)

- industrial products:

- aluminum products (tariffs of up to 7.5% were eliminated upon entry into force)

- plastic tubes (tariffs of up to 4.8% were eliminated upon entry into force) and

- iron and steel products (tariffs of up to 6.3% will be eliminated within 10 years).

- agricultural goods, such as:

- The CPTPP also reduces or eliminate tariffs on beef and pork, allowing Canadian exporters to benefit from access to the Japanese market on par with key competitors.

- On beef, tariffs of 38.5% on fresh, chilled, and frozen beef, as well as tariffs of up to 50% on certain offal, will be reduced to 9% within 15 years.

- The CPTPP levels the playing field for Canadian exporters relative to countries like Australia that already enjoy preferential access to the Japanese market, and also gives Canada an advantage compared to lead U.S. competitors.

- On investment, the CPTPP allows Canadian companies to invest with greater confidence in Japan, offering them protections from unfair and discriminatory treatment, as well as greater predictability and transparency.

- Through the CPTPP, service providers also benefit from improved access commitments in key sectors such as:

- professional services (e.g. urban planning, landscape architectural services)

- research and development services

- environmental services

- transportation services and

- other business services (e.g. services related to manufacturing and technical testing and analysis services).

- New commitments on the temporary entry of business people now make it easier for certain categories of Canadian business people to temporarily work in Japan, including high-skilled Canadian professionals and technicians as well as their spouses.

- The CPTPP also provides robust and enforceable provisions on labour and environment.

Sectoral opportunities in Japan

- Investment

- CPTPP investment rules provide greater certainty and protection for investors, while preserving the rights of federal and provincial governments to legislate and regulate in the public interest.

- In areas such as energy, mining, manufacturing, financial services and professional services, Canadian investors enjoy transparent and predictable access to CPTPP markets, including Japan.

- Strong rules help to ensure that Canadian investors are treated in a fair, equitable and non-discriminatory manner, allowing them to compete on an equal footing with other investors in CPTPP countries.

- Canadian investors also have access to an investor-state dispute settlement mechanism that is independent and transparent.

- Agriculture and agri-food

- Japan is the world’s largest net importer of food and Canada’s third largest market for agri-food and seafood products, with exports totaling $4.2 billion (average 2015-17).

- The CPTPP will create significant opportunities to increase Canada’s market share in products like beef, pork, grains and oil seeds, and functional foods and nutraceuticals. For example, with regard to pork products, which are subject to tariffs of up to 20% and the gate price systemFootnote1, Japan will eliminate its tariffs on Canadian imports within 10 years of entry into force. On beef, the tariffs of 38.5% on fresh/chilled and frozen beef, as well as tariffs of up to 50% on certain offal, will be reduced to 9% within 15 years of entry into force.

- Similarly, for wheat, Canada will have access to a Canada-specific annual quota for food wheat which starts at 40,000 tonnes and grows to 53,000 tonnes within six years of entry into force.

- Mark-ups within this country-specific quota will be reduced by 45% or 50%.

- Seafood products

- Canadian exporters of seafood products benefit from the elimination – either upon entry-into-force or phased out – of all fish and seafood tariffs. This includes tariffs ranging from 3.5% to 15%, including fresh, chilled or frozen salmon (including fillets), snow crabs, herring roe, and live, fresh or chilled sea urchin and roe.

- Forest products and value-added wood products

- Japan is one of Canada’s most successful markets for forest products and value-added wood products.

- CPTPP gains in this sector include the elimination of all Japanese tariffs on forest products and value-added wood products. This provides significant opportunities for Canadian wood exporters in the Japanese market. Products include lumber, plywood and veneer panels, oriented strand board, worked coniferous and non-coniferous wood, and sheets for veneering.